Kanawha County Assessor

Our mission is to perform professionally the statutory duties of the County Assessor with integrity, independence, and a spirit of technological innovation while emphasizing outstanding customer service, excellent public information, and efficient use of taxpayer resources with a streamlined, well-trained and appropriately compensated staff.

Kananwha County Assessor

Our mission is to perform professionally the statutory duties of the County Assessor with integrity, independence, and a spirit of technological innovation while emphasizing outstanding customer service, excellent public information, and efficient use of taxpayer resources with a streamlined, well-trained and appropriately compensated staff.

Office of the Kanawha County Assessor

Sallie Robinson

Assessor

Welcome to the Kanawha County Assessor's Website

New to the Area?

We would like to extend a warm welcome to you from the Kanawha County Assessor’s Office.

Click below to find out more information we hope will make your transition into the county smoother.

Pay Taxes

Need to pay personal property or real estate taxes?

Please click below to be directed to the Kanawha County Sheriff’s Tax Office.

Important Dates

Commercial Business Return form Due September 1st

Real and Personal Property Assessment form Due October 1st

Homestead Exemption form Due December 1st

Online Filing

Looking to file your Individual Personal Property Form or Business Property Form online please click below. We offer the ability to go paperless and have instant filing of your yearly forms.

***ONLINE FILING IS NOW OPEN***

Property Inquiry

Search property records by owner or address

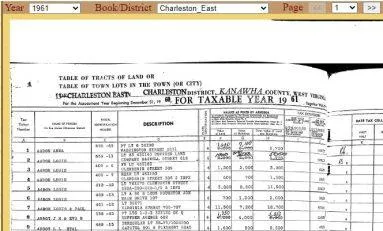

View land book information

Access property map cards

Look up any property in Kanawha County with the IAS Portal.

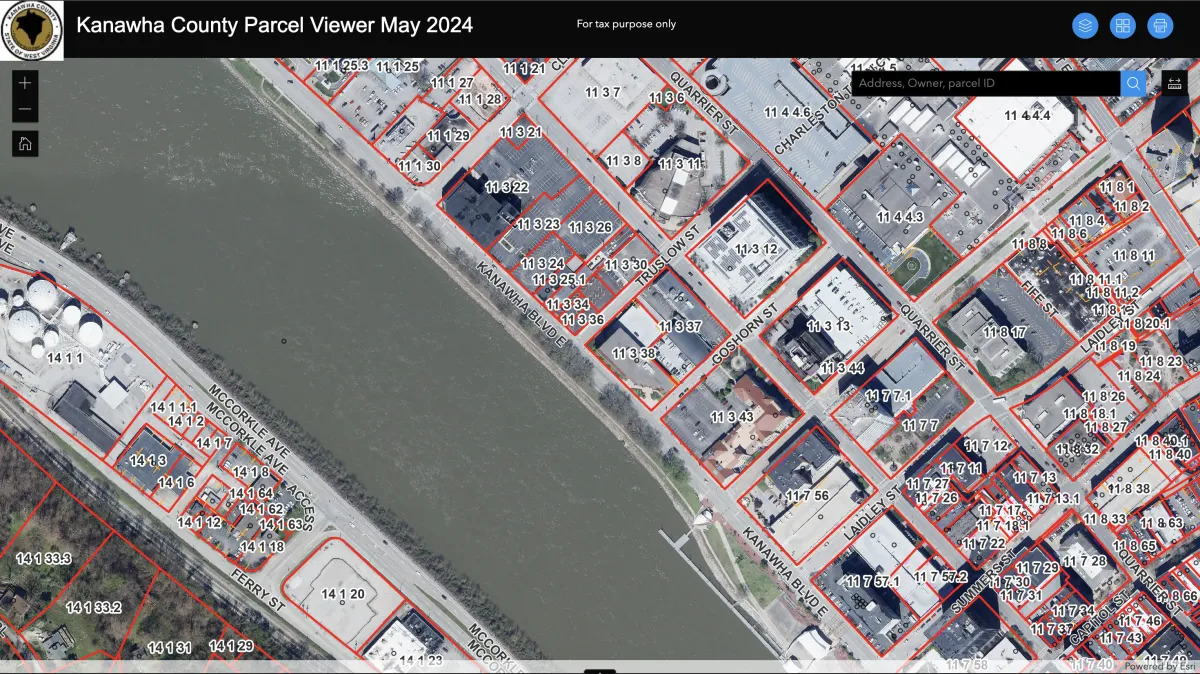

Mapping/GIS Data

The purpose of the GIS department of the Kanawha County Assessor’s Office is to create and maintain digital and paper tax maps. We also maintain a database of all parcels taxed within the county’s boundaries. We are currently working to provide a more accurate paper representation of all tax parcels available to the public using digital mapping. This will allow tax parcels to be clearly and accurately depicted based upon public records. Our goal is to create a map that is appealing to the public as well as accurate based upon deeds, surveys, etc. This will not only help the taxpayer to be able to locate their property, but will also afford our appraisal department the ability to fairly and accurately evaluate properties. It is also the goal of our department to be public friendly. We enjoy working very closely with surveyors, property appraisers and the citizens of our county.

The Kanawha County Parcel Viewer is provided by the Kanawha County Assessor’s Office to allow for easy access and a visual display of County information. Every reasonable effort has been made to ensure the accuracy of the maps and data provided; nevertheless, some information may not be accurate. The Kanawha County Assessor assumes no responsibility arising from the use of this information.

THE MAPS AND ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND, either expressed or implied, including but not limited to, the implied warranties of merchantability and fitness for a particular purpose. Do not make any business decisions based on data before validating your decision with the appropriate County office. The Assessor parcel maps are for assessment use only and DO NOT represent a survey. The Assessor parcel maps are compiled from official records, including surveys and deeds, but only contain the information required for assessment.

Homestead Exemption

The Homestead Disability Exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. You can receive a reduction of up to 20,000 from the assessed value of your home.

To Qualify you must be:

65 or older on or before June 30th (unless totally disabled)

Or be totally disabled. (requires submission of disability letter)

Or honorably discharged Veteran homeowner 90%-100% disabled. (requires submission of disability letter)

Been a resident of West Virginia for 2 years.

Lived at your residence for at least 6 months.

YOU CAN NOW FILE FOR HOMESTEAD ONLINE

Data Entry

Search property records by owner or address,

View land book information

Access property map cards

Look up any property in Kanawha County with the IAS Portal.

Homestead Exemption

The Homestead Disability Exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify.

Farms

Parcels used for agricultural purposes, that meet the minimum production value requirements can receive a substantial discount on the taxable valuation of the property. Find out more information below. You can also submit your Farm Census online here.

Forms

Click here to access paper copies of all of our fillable forms They include Personal Property Business

Personal Property Business Return

Individual Personal Property Return

Dog Tag application

Disaster Relief Application

Homestead Application

and more...

Forms

Click here to access paper copies of all of our fillable forms They include Personal Property Business

Personal Property Business Return

Individual Personal Property Return

Dog Tag application

Disaster Relief Application

Homestead Application

and more...

Tags or Decal Orders

Need to acquire a Dog, Sheep, or Goat Tag or a Farm Decal. Please click the button below

About Us

Like to learn more about the Assessor’s Office and how we assess properties?

Forms

Click here to view all forms

Contact Us:

Click here to contact the Kanawha County Assessors office