Assessor’s Office

The Assessor and her deputies are directed by West Virginia Constitution, Article X, Section I, to determine the value of all real and personal property at fair market value for each tax year. The specific duties of the assessor are to discover, list, and value all Real and Personal property within the boundaries of the county on an annual basis. All valuation work must occur on a fiscal year basis commencing on the first day of July. On June 30th of the following year, the collection year ends and the books close.

Your Assessor does not set your property tax. Your tax bill is determined by multiplying a tax rate against your assessed value (60% of market value). Remember that the Assessor determines your assessed value, and the legislature (for the board of education), the county commission, and the municipalities determine the levy rate. Levy rate information is prepared for your convenience and may be obtained in the Assessor’s office.

The position that the Assessor’s office occupies in relation to the taxes collected is one of providing a value to each levying body. Once this is completed, the levying bodies, i.e. county school board, county commission, etc., approve their levies. It is at this point in the process that taxes are determined. Levy rates may rise or fall depending on the amount of funding that each levying body requires but are regulated by constitutional provisions.

The property tax process has three major components:

Assessor– establishes a fair market value for all real and personal property and communicates it to the levying bodies.

Levying Bodies– i.e. West Virginia Legislature, Board of Education, Town and City Councils, Parks & Recreation, Library and Mass Transit all provide the components that make up the total levy rate applied to the values.

Sheriff– mails all statements, collects all money except for dog taxes, and disperses to each levying body its portion of the total levy.

Seventy–two percent of all property taxes collected go to support the public school system. The remainder of the taxes collected are shared by the County, the Cities, Towns and State of West Virginia.

Personal Property

The Personal Property Division of the Kanawha County Assessor’s Office determines the value of all tangible personal property. Tangible personal property is defined as cars, trucks, vans, motorcycles, scooters, travel trailers/campers, motor homes, boats and trailers, utility trailers, dozers, backhoes, welders, recreation 4-wheelers, show or race horses, show or race dogs, etc.

This also includes unlicensed vehicles and antique vehicles. WV Code 110-1N-4.1 The local Assessor shall use a current appraisal guide published by a recognized authority, directed by the Tax Commissioner for the month of July of the current assessment year to ascertain the appraised value of your vehicles based on the lowest value in the subject guide. After an appraised value is determined, the assessed value is 60% of the determined appraised value. The Assessor does not set your tax amount.

WV Code Chapter 11-3-2 requires all residents to file a report of their real and personal property each year of what they owned on July 1

st. Our office provides a pre-printed report delivered to your home address during the first week of July with instructions of how to fill the form out along with a self addressed envelope for your convenience to return the form to our office by October 1, If you are not receiving a form please contact our office at (304)357-0250.

We now have the option to pay your Dog, Sheep, Goat, and Farm tags Online. CLICK HERE

Vehicle Assessment

Vehicles

Vehicles such as cars, trucks, vans, motorcycles, watercrafts, etc. are appraised from the loan value of the NADA (National Automobile Dealers Association) Guide mandated by the WV State Tax Commissioner. Once the appraised value is determined for the vehicle, it is assessed by taking 60% of the appraised value to arrive at an assessed value. The assessed value of the vehicle is entered to the personal property file. The taxes are extended by multiplying the assessed value by the levy rate of that tax year. THE LEVY RATES ARE DETERMINED BY THE LEVYING BODIES OF EACH COUNTY; SUCH AS THE KANAWHA COUNTY COMMISSION, THE KANAWHA COUNTY SCHOOL BOARD AND MUNICIPALITIES.

Antique

VehiclesAntique vehicles are valued from the “Old Cars Pricing Guide” that is approved by the State Tax Commissioner. Our office also requests a recent photo of the antique car so that we can determine the quality of the antique car and whether it is in parts, restorable, or fair condition. The assessed value is determined the same as regular vehicles by taking 60% of the appraised value.

Boats and Recreational Vehicles

Boats and recreational vehicles are also valued from the NADA price guide for boats and recreational vehicles. Our office uses the lowest value of that book, and like vehicles, we use 60% of the appraised value to determine the assessed value.

Mobile Homes

Mobile Homes

Mobile Homes can be assessed as Personal Property or Real Property. If you do not own the land your mobile home is on and you hold the title of the mobile home, it will be assessed on the Personal Property books. If you do own the land the mobile home is sitting on, it can be assessed as Real Property.

Mobile Homes as Personal Property

Should the taxpayer own a mobile home and it is situated on rental land, it should be listed on the mobile home section of the Individual Assessment Report. You should list the trade name, size, year, and purchase date. Also, we would need to know if the mobile home is owner occupied to determine a tax class and whether it should be in class 2 (occupied by the owner) or class three or four (occupied by a renter, vacant or commercial in or outside the city limits). You should list the property owner so that the office can determine where the mobile home is located.

Mobile Homes as Real Property

If you own the mobile home and the land that it is sitting on, it can be placed on the Real Estate books. Tax Class is also determined the same as above. It should also be listed on the Individual Assessment report under “List of Real Estate Owned” listing the map and parcel number or the account number from your tax statement.If someone parks a mobile home on your land, please complete the appropriate section. List the name and phone number of the owner of the mobile home.

Active Duty Military Exemption

The only property tax exemptions that apply to motor vehicles owned by active duty military personnel are authorized under the Soldiers and Sailors Civil Relief Act of 1940 and under Executive Order 9-88.

These provisions, respectively, provide property tax exemptions for:

The non-business personal property owned by a person on active duty who is not a West Virginia resident, but who is in West Virginia on military orders.

A motor vehicle owned by a person on active duty who is a resident of West Virginia but who is assigned to permanent duty outside the State, if the vehicle is located outside of West Virginia on July 1, and has been or will be located out of State for a period of not less than 30 consecutive days, including the July 1 assessment day.

Dog Tag

WV Code §19-20-2 states that it is the duty of the Assessor to collect a yearly head tax on each dog 6 months of age or older by June 30. The fee is $3.00 per dog. You will need to include a check or money order (made payable to the Kanawha County Assessor, no cash please) with your assessment form. Your dog tags will be mailed to the address listed on your assessment form. You may also click here for a Dog Tag Application or go to FORMS from the Menu Bar. Complete and mail as directed. All current tags are void as of June 30th of the following year.

If you live within the city limits of Charleston, South Charleston, St. Albans, Dunbar, Nitro, you may also pay the city dog tax to the Assessor.

Sheep/Goat Tax

Under the Authority of West Virginia Code §7-7-6e: After the thirtieth day of June, two thousand five, it shall be the duty of the county assessor and his or her deputies of each county within the state at the time they are making assessments of the personal property within such county, to assess and collect an assessment of $1.00 on all breeding age sheep and $1.00 on all breeding age goats.

Aircraft

In accordance with provisions of WV Code §§ 11-3-2, 11-3-12, and 11-3-15; all persons owning or controlling real or personal property subject to property taxation are required to render a property tax return to the Assessor. Among other items, this requirement includes the reporting of aircraft. In this regard, owners of aircraft are to verify the make, model, model number, year, registration tail number and the acquisition cost of such craft. If you are a business owner, this information should be reported under Schedule E of the business property return.

In addition, West Virginia Code §11-6H-1 et seq. provides that the value of special aircraft property shall be its salvage value. Special aircraft property is defined to be “…all aircraft owned or leased by commercial airlines or private carriers.” Private carrier means “… any firm, partnership, joint venture, joint stock company, any public or private corporation, cooperative, trust, business trust or any other group or combination acting as a unit that is engaged in a primary business other than commercial air transportation that operates an aircraft for the transportation of employees or others for business purposes.”. If you have reported aircraft on Schedule E which you believe to be special aircraft property, enter the dollar value of the aircraft at 100 percent of acquisition cost

Real Estate

Real Property may be defined as consisting of all parcels of surface real estate, all buildings permanently affixed (when owned by the same owner as the land), and most mineral real property interests. (See Section 16 concerning minerals and W.Va. Code §11-5-3 concerning distinctions between real and personal property.) Real Property may be in Class II, III or IV. (See W.Va. Code §11-8-5).

Appraisers

The Kanawha County Assessor is required to revisit every home owner every three years to ensure your property is evaluated properly and fairly. They will arrive in a Kanawha County Assessor marked vehicle and will have a photo I.D. and business cards. If you are not home the field agent will leave a door hanger with information for you to contact the Kanawha County Assessor’s Office. Please contact the appraiser at the phone number listed on the door hanger, our appraisers have questions that if left unanswered could result in improper values.

The field data collectors consist of residential and commercial appraisers. All appraisers have received up to date training and certifications through the West Virginia State Tax Department. They are responsible for maintaining current market values on approximately 135,000 parcels of real estate in Kanawha County. All appraisers will have picture identification with them at all time. If in doubt, please feel free to contact our office at 304-357-9043 to verify.

Classes of Property

The Tax Limitation Amendment of 1932 defines the four classes of property in West Virginia and provides for the maximum levy rate that is to be charged on each class.

For the purpose of levies, WV Code §11-8-5 classifies property as follows:

Class I – No longer taxable.

Class II – All property owned, used and occupied by the owner exclusively for residential purposes; all farms, including land used for horticulture and grazing, occupied and cultivated by their owners or bona fide tenants.

Class III – All real and personal property situated outside of municipalities, exclusive of Classes I and II.

Class IV – All real and personal property situated inside of Municipalities, exclusive of Classes I and II.

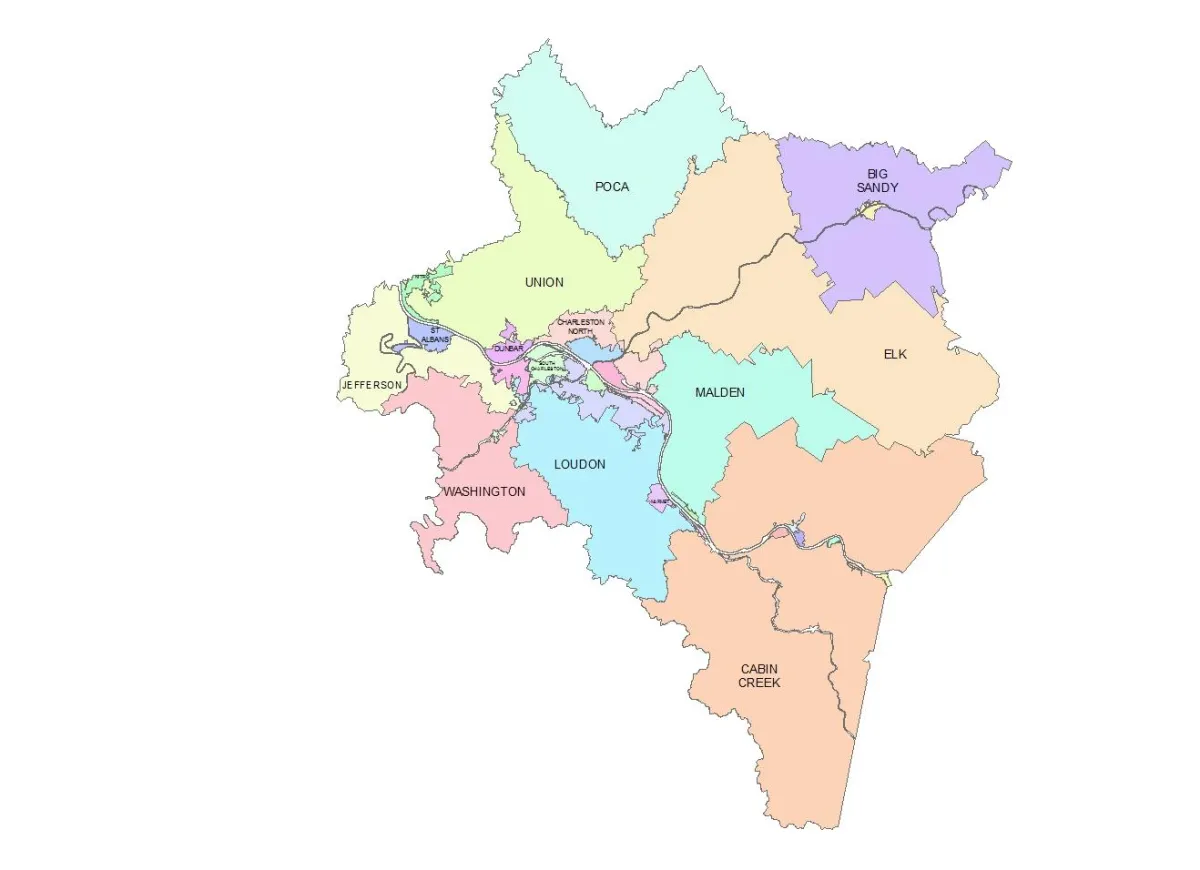

Tax Districts

01 – Big Sandy

02 – Clendenin

03 – Cabin Creek

04 – Cedar Grove

05 – East Bank

06 – Glasgow

07 – Montgomery

08 – Pratt

09 – Charleston So. Annex

10 – Charleston North

11 – Charleston East

12 – Charleston West

13 – Kanawha City

14 – 15th Ward

15 – Elk

16 – Jefferson

17 – St. Albans

18 – Spring Hill

19 – Loudon

20 – Chesapeake

21 – Marmet

22 – South Charleston

23 – Malden

24 – Poca

25 – Union

26 – Dunbar

27 – Nitro

28 – Washington

29 – Belle

31 – Handley

Below is a map of the districts of Kanawha County: