New To The Area?

Hello and welcome to Kanawha County. As a new resident, we are here to help guide you through the process of registering with our office and complying with the property tax requirements in West Virginia. You may take advantage of any discounts you are eligible for and avoid any penalties or unnecessary fees.

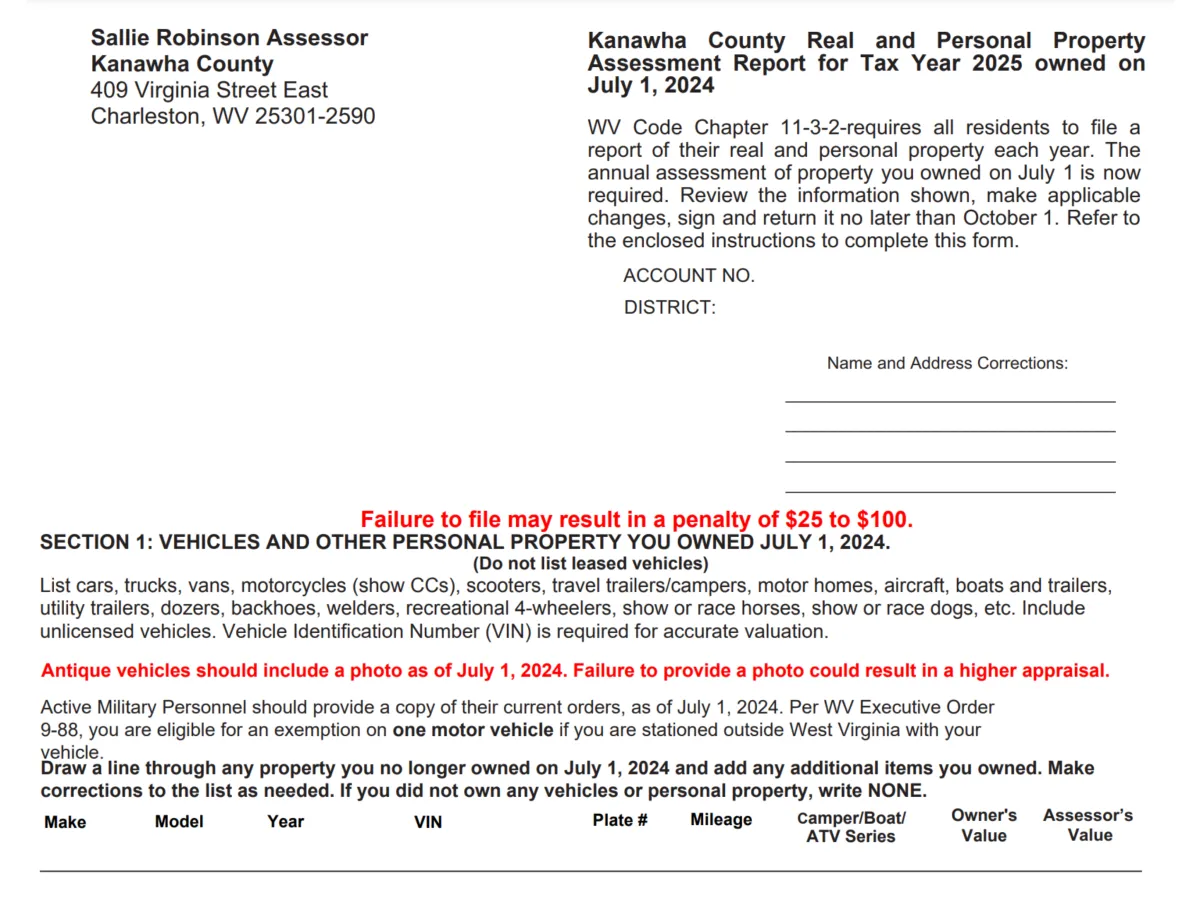

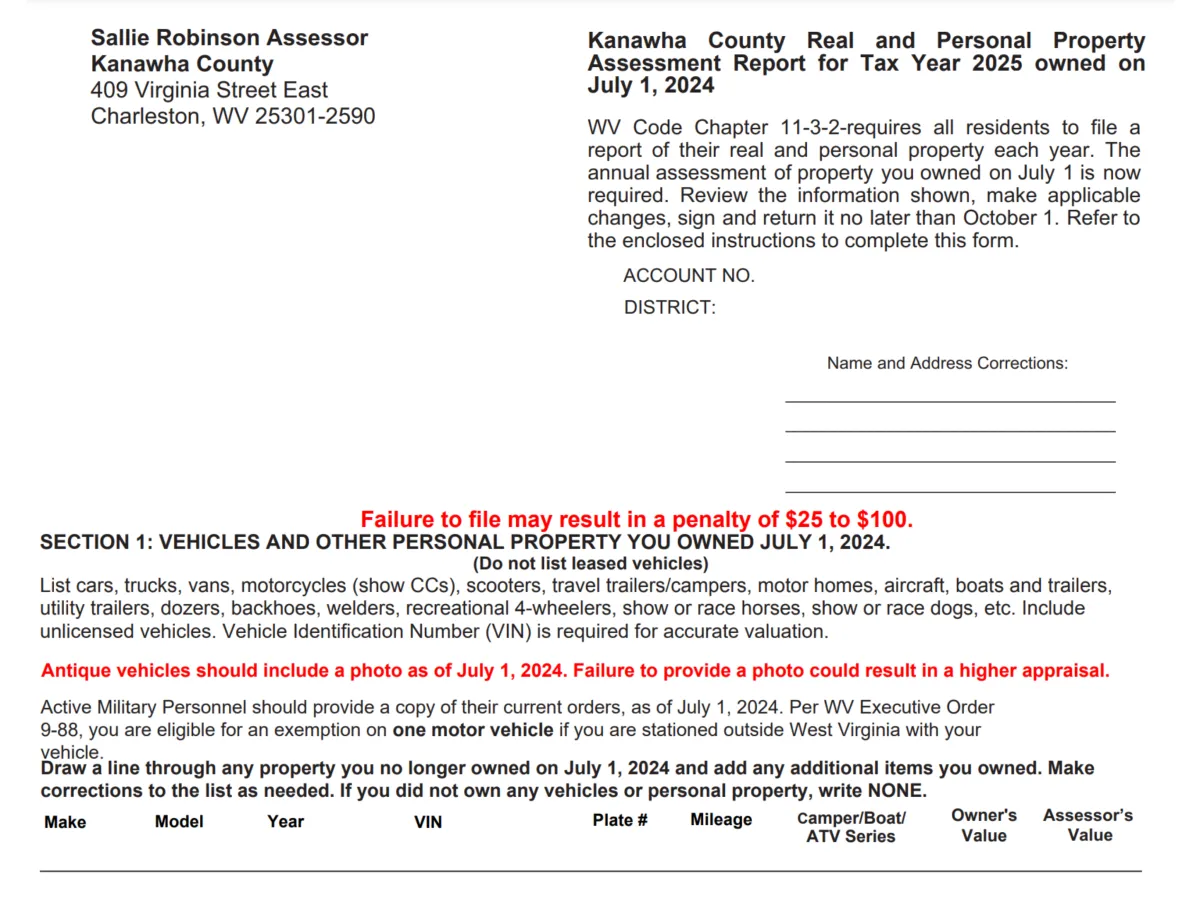

Assessment Form

Each year in West Virginia, every citizen is required to file a property return with their local county assessor on or before October 1st. On it you must list real and personal property you owned as of July 1st of the current year, as well as any sheep or goats. Once you have registered your property with our office, we can officially assess your personal property using the NADA Guide or other national approved pricing guide. You may call our office or use the link below to get the Property Return form. Once you have submitted your form you will be setup for the future for receiving your personal property form by mail. Make sure you submit the form before October 1st to avoid a penalty.

Assessment Form

Each year in West Virginia, every citizen is required to file a property return with their local county assessor on or before October 1st. On it you must list real and personal property you owned as of July 1st of the current year, as well as any sheep or goats. Once you have registered your property with our office, we can officially assess your personal property using the NADA Guide or other national approved pricing guide. You may call our office or use the link below to get the Property Return form. Once you have submitted your form you will be setup for the future for receiving your personal property form by mail. Make sure you submit the form before October 1st to avoid a penalty.

Homestead Exemption

If you are 65 or older or are totally disabled, you can receive a Homestead Exemption. You must be living at your residence for at least 6 months and been a resident of West Virginia for 2 years. This exemption will reduce the assessed value of your primary residence by $20,000, with a corresponding reduction on your real property taxes. You can apply for the exemption if you will be 65 on or before June 30th, or at any time if you are disabled. You must provide proof of age or disability. The statutory deadline for applying for this exemption for the coming tax year is December 1st, and the Assessor cannot accept Homestead Applications after this date. There is a link below to the Homestead Exemption page where you can find the application. You may also come into the Assessor’s office and we can get you signed up. Make sure to take advantage of this discount as soon as you are eligible. If you don’t apply, you will not receive the discount.

Homestead Exemption

If you are 65 or older or are totally disabled, you can receive a Homestead Exemption. You must be living at your residence for at least 6 months and been a resident of West Virginia for 2 years. This exemption will reduce the assessed value of your primary residence by $20,000, with a corresponding reduction on your real property taxes. You can apply for the exemption if you will be 65 on or before June 30th, or at any time if you are disabled. You must provide proof of age or disability. The statutory deadline for applying for this exemption for the coming tax year is December 1st, and the Assessor cannot accept Homestead Applications after this date. There is a link below to the Homestead Exemption page where you can find the application. You may also come into the Assessor’s office and we can get you signed up. Make sure to take advantage of this discount as soon as you are eligible. If you don’t apply, you will not receive the discount.

Dog Tags

In West Virginia you are also required to register and get tags for any dogs you have. The county fee is $3.00 per dog. If you live within the city limits of Charleston, Dunbar, Nitro, South Charleston, or St. Albans you must also register your dogs there as well and that fee is also $3.00 per dog. Dog tags must be renewed every July 1st and are good for one year. As a courtesy we can take care of both the county and municipality fees, so you don’t have to go to two places to get them. There is a link to the form below or you may call our office and have the form mailed to you or you can come into the Assessor’s office and we can take care of it right there for you.

Dog Tags

In West Virginia you are also required to register and get tags for any dogs you have. The county fee is $3.00 per dog. If you live within the city limits of Charleston, Dunbar, Nitro, South Charleston, or St. Albans you must also register your dogs there as well and that fee is also $3.00 per dog. Dog tags must be renewed every July 1st and are good for one year. As a courtesy we can take care of both the county and municipality fees, so you don’t have to go to two places to get them. There is a link to the form below or you may call our office and have the form mailed to you or you can come into the Assessor’s office and we can take care of it right there for you.

If you have any questions, please call our office at (304) 357-0250 and we will be happy assist you and answer your questions.